College & Education Planning

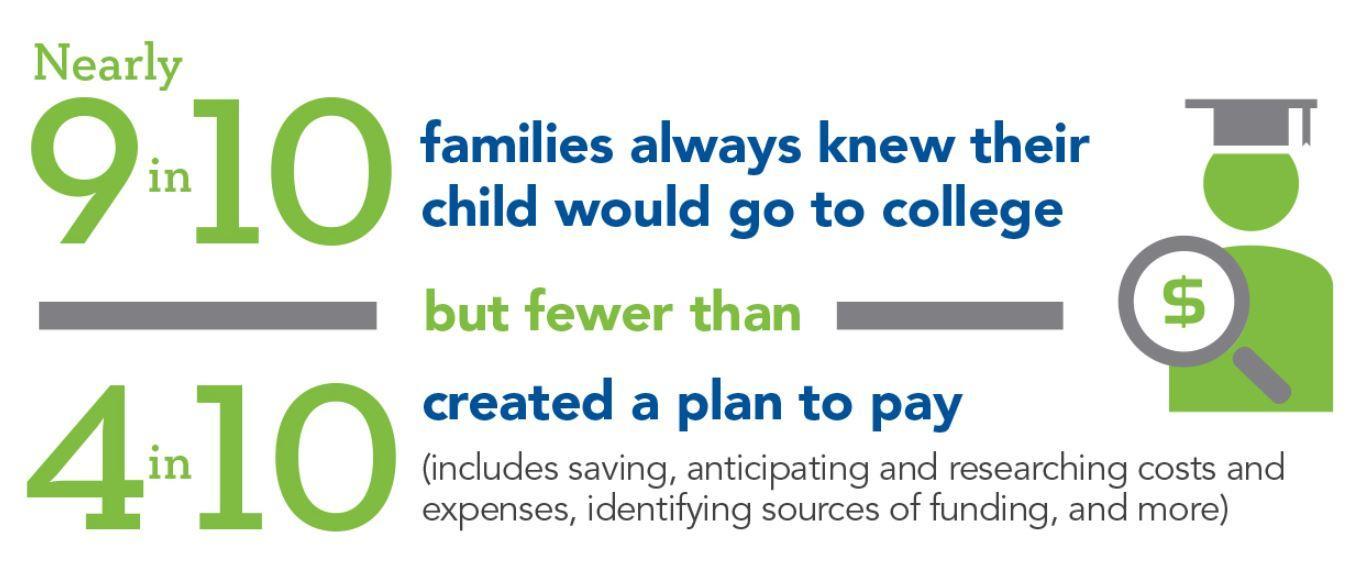

In a world where college tuitions are rising every year, having a comprehensive college savings plan is increasingly important. Start your monthly contributions early to see optimal results. Adding $350 per month to a college savings account starting when your child is 10 years old can yield $42,990 by the time the child is 18. However, contributing the same amount starting when the child is born could yield $135,574; a difference of $92,584

(This is a hypothetical example and is for illustrative purposes only. It assumes a 6% interest rate. No specific investments were used in this example. Actual results will vary and are subject to change. Past performance does not guarantee future results).

Other College Opportunities

- Texas B-On-Time (BOT) Loan - The Texas B-On-Time Loan program is a zero-interest loan. Your institution's financial aid office will determine if you are eligible. If this loan is offered to you, the financial aid office will instruct you to complete an application and promissory note online.

- UT DALLAS – Guaranteed Tuition Plan and Comet Connection - The UT Dallas Guaranteed Tuition Plan promises to lock your tuition rate and mandatory fees for the four-year period beginning with your registration. Those who begin their college careers at a community college will also be able to take advantage of UT Dallas' Guaranteed Tuition Plan under a new program called the Comet Connection. Every two-year college in Texas, both public and private, participates in the Comet Connection.

- Federal Pell Grant Program - The Federal Pell Grant Program provides need-based grants to low-income undergraduate and certain post baccalaureate students to promote access to postsecondary education.

- Texas Grant–Program Purpose - The Texas Legislature established the TEXAS (Towards Excellence, Access and Success) Grant to make sure that well-prepared high school graduates with financial need could go to college.

- Texas Tuition Promise Fund®, the state's newest prepaid tuition plan - Lock in tomorrow's college tuition costs at Texas public colleges and universities at today's prices. The new Texas prepaid tuition plan, the Texas Tuition Promise Fund, will give you an important opportunity to prepay and save for your child's future education.

- Grants, Loans, and Scholarships Website for Texas Residents

- 529 College Savings Plans and Grandparents - Grandparents college help, even savings plans, could end up hurting students.

- Common Questions About 529 Plans - The time has come to send your loved one to college, which means it may be time to start taking withdrawals from your 529 college savings plan.

Other 529 Opportunities

Congress created the 529 ABLE account as a savings vehicle for disabled people that offers the same tax-free growth available in 529 college-savings plans. It is the 529A account.

*The fees, expenses, and features of 529 plans can vary from state to state. 529 plans involve investment risk, including the possible loss of funds. There is no guarantee that a college-funding goal will be met. In order to be federally tax-free, earnings must be used to pay for qualified higher education expenses. The earnings portion of a nonqualified withdrawal will be subject to ordinary income tax at the recipient’s marginal rate and subject to a 10-percent penalty. By investing in a plan outside your state of residence, you may lose any state tax benefits. 529 plans are subject to enrollment, maintenance, and administration/management fees and expenses.